do pastors pay taxes in canada

How much does a Pastor make in Canada. Cant speak for Canada but US.

How Much Should You Pay Your Pastor The Pastor S Soul

It is generally accepted that the church is an entity that does not pay taxes.

. The church also pays for group insurance and 180000 to a Retirement Savings Plan. Get estimated pay range. Churches Cannot Withhold SECA Taxes For Pastors.

If the church owns and provides a home for the pastor and his family the rental value of the home will be added as a taxable benefit and included in his T4 return. Pastors pay under SECA unless they have opted out in which case they pay nothing. This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed.

The average salary for a pastor is 59225 per year in Canada. To be eligible an individual must meet both a status test and a function test. Churches Can Withhold Income Taxes For.

This income is considered employee wages. Since you owe 50 of the capital gains youll have to pay taxes on 4500 50 of 9000. Second churches are not allowed to withhold SECA taxes for pastors.

The status test in the Christian Reformed Church CRC context is normally met where an. On your T4 slip if you receive a housing allowance you can find your receipt. Non-pastor church employees pay under FICA SECA if your church is exempt.

Do pastors pay taxes in canada. If both you and your spouse or common-law partner are claiming clergy residence deductions the person with the higher salary should complete the calculation on the Form T1223 first showing 0 on line 7 of Part CThe person with the lower salary should then take into consideration the deduction with respect to the clergy residence made by the person with the higher salary and. Much has been written about the clergy residence deduction CRD which is available to clergy and other eligible individuals in Canada.

Taxable Life Ins Benefit 4526. A place of public worship would seem to have a fairly clear meaning. 17 salaries reported updated at May 18 2022.

In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes. An employee who is a member of the clergy a regular minister or a member of a religious order can claim the clergy residence deduction if the. How Much Tax Does A Pastor Pay.

Nevertheless there have been a few court battles when for example a Christian summer camp wanted the exemption. The inclusion of the allowance in your income may be offset by a special deduction available only to clergymen found on Line 23100 Clergy Residence Deduction of your return. If you are eligible for the deduction you can deduct the full amount of your housing allowance or taxable benefit by completing Form T1223.

Does the church pay taxes Canada. The contractor has to report the value of the ETH as business income which would be the full 10000. If your employee is a member of the clergy they may be able to claim a deduction from income for their residence when filing a personal income tax and benefits.

The pastor will be able to claim the Clergy Housing Deduction as outlined in item 5 below e. The following shows how to calculate the monthly deductions. Because the gifts were his main source of income instead of a stated salary the court ruled that it essentially was his salary.

The donations far exceeded the pastors salary. Average base salary Data source tooltip for average base salary. Trading and holding crypto is easy.

Neither the pastor or the church has any say in the matter thats just the way it is. If the church owns and provides a home for the pastor and his family the rental value of the home will be added as a. It is a complex piece of legislation essentially boiling down to the premise.

Clergy Housing Tax Free - Canada. Clergy Residence Deduction. Pastor provides hisher own accommodation the church offers just a gross salary and the pastor is responsible to determine the fair market rental value of their house or apartment and hence the amount that they will claim as Clergy Residence Deduction.

The BC Supreme Court however. Catholic hospitals There are over 100 Catholic hospitals in Canada and the bulk of their funding comes from provincial governments. In Canada religious institutions are tax exempt if they are deemed to create public benefit.

You just pay 50 of your capital gains. Sub Total 1 ABC 424962. The average salary for a Pastor is C51389.

For pastors and clergy members themselves it may change the decision to itemize too. Taxable LTD Benefit 5436. If a church withholds FICA taxes for a pastor they are breaking the law.

Like any other taxpayer if you work for a religious order or parish member or serve as a regular minister in a religion or religious denomination you report your earnings when reporting them to the IRS. If your employee is a member of the clergy they may be able to claim a deduction from income for their residence when filing a personal income tax and benefits return. Taxpayers view ministers as self-employed employees with the same tax deductions as traditional employees.

Due to their status as self-employed ministers do not have to pay income taxes to the governmentThe employers of ministers however are able to withhold taxes on behalf of the ministermay make for an easier payment method compared with quarterly estimated payments. With the 2018 tax changes the standard deduction is up by between 150 and 300 depending on filing status. Pastors most certainly pay taxes on their income.

You are considered an employee for retirement plan purposes. If a church withholds SECA taxes it can mess up the pastors records with the Social Security Administration. Do Ministers Pay Income Tax In Canada.

In addition to the blue envelope gifts the pastor took a housing allowance of 6500 a month. Section 15 1 of the Taxation Rural Area Act says that every place of public worship is exempt from property taxation. Which should be taxable.

Attached as Exhibit A d. Whenever you earn salary wages or other income from your position as a parish priest or a member of a religious order or as a minister of a religious denomination this income must be reported to the IRSThere is an automatic T4 form with Box 30 which shows how much housing allowance you received based. This means congregation members may be less tempted to itemize which could reduce giving to churches.

Do Pastors Pay Income Taxes In Canada. If requested by Canada Revenue Agency CRA. The church is not obligated to withhold income tax.

Since the ministers employer is the church income tax from ministry income is exempt.

Does The Catholic Church Get Government Funding In Canada Quora

Clergy Housing Tax Free Canada The Network

What Taxes Do Churches Pay In Canada Ictsd Org

Called To Canada Non Canadian Pastors Serving Canadian Churches The Network

Church Stewardship Church Ownership The Church Is Not Ours The Vision Of The Church Is Not Ours It Is God S As Leaders You Must Articulate The Vision Ppt Download

The Clergy Residence Deduction And Payroll Taxes Abnwt District Resource Centre

Should Churches Be Tax Exempt R Canada

Should Priests And Pastors Pay Tax Quora

Should Churches Be Tax Exempt R Canada

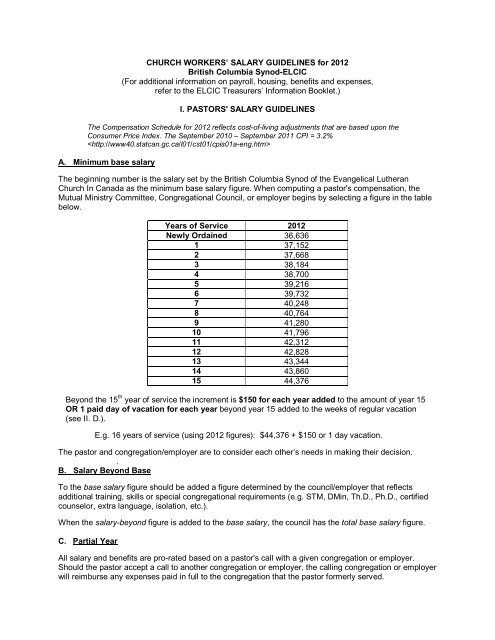

Church Workers Salary Guidelines For 2012 Bc Synod

Pastors Parsonage Or Own Home Church Investors Fund

Pastor Appreciation Day Are Your Love Offerings Taxable Income To Your Pastors Stanfield O Dell Tulsa Cpa Firm

Huge Infographic On The Business Of Mega Churches Tax Exempt Average Pastor Income 147 000 Many In The Millions Sees Gifts Of Bentleys And Rolls Royces Attendance Growing 8 Per Year Just Take A Look