how to calculate nh property tax

Ad Research Is the First Step to Lowering Your Property Taxes. New Hampshire has the 3rd highest property tax rate in the country.

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year.

. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in. The 2019 tax rate is 1486 per thousand. Enter Your Address to Begin.

The 2020 tax rate is 1470 per thousand dollars of valuation. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. Total Estimated Tax Burden.

Browse Current and Historical Documents Including County Property Assessments Taxes. State Education Property Tax Warrant. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning. State with an average effective rate of. The 2020 real estate tax rate for the town of stratham nh is 1895 per 1000 of your propertys assessed value.

Taxes that remain unpaid after New Hampshire property tax due dates are charged an interest of 12 per year. Our New Hampshire Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in New Hampshire and across the entire United States. New Hampshire Property Tax Calculator - SmartAsset.

Take the purchase price of the property and multiply by 15. Heres how to find that number. If your Concord New Hampshire home is valued at 365000 you can expect to pay 8245 in property taxes per year.

By law the property tax bill must show the assessed value of the property along with the tax rates for each component of the tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Houses 6 days ago Overview of New Hampshire TaxesNew Hampshire is known as a low-tax stateBut while the state has no personal income tax and no sales tax it has the fourth-highest property tax rates of any US.

New Hampshire Property Tax Calculator. Enter your Assessed Property Value Calculate Tax. Income Tax.

New Hampshires tax year runs from April 1 through March 31. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. At this stage you may need service of one of the best property tax attorneys in Pittsfield NH.

Calculate your real tax payment including any exemptions that apply to your real estate. Property taxes are the main source of income for Rochester and the rest of local public units. This calculator is based upon the State of New Hampshires Department.

Property tax is calculated based on your home value and the property tax rate. To use the calculator just enter your propertys current market value such as a current appraisal or a recent. Percent of income to taxes.

Realistic property value growth wont boost your yearly payment enough to make a protest worthwhile. In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. Although the Department makes every effort to ensure the accuracy of data and information.

167 as was in effect on June 30 1981. New Hampshire Property Tax Calculator to calculate the property tax for your home or investment asset. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the.

However if you live in New Hampton New Hampshire youre property taxes significantly dip to 6406 a year. 300000 x 015 4500 transfer tax total 2. 2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to.

More than other states New Hampshire cities count on the real property tax to support governmental services. Divide the total transfer tax by two. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

The 2021 tax rate is 1503 per thousand dollars of valuation. Municipal local education state education county and village district if any. In NH transfer tax is split in half by buyer and seller.

To calculate the daily interest charge you owe the state multiply the tax bill with 012 then divide by 365 for days in a single year. For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. New Hampshire Real Estate Transfer Tax Calculator.

The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the NH property tax calculator. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. Your household income location filing status and number of personal exemptions.

Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. Together with counties they all depend on real property tax revenues to carry out their public services.

Understanding New Hampshire Taxes Free State Project

What You Should Know About Moving To Nh From Ma

Understanding New Hampshire Taxes Free State Project

Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

Financial Due Diligence For Real Estate Investors The Only Two Formula Real Estate Investor Financial Investing

Monday Map Tax Increase From Fiscal Cliff For Median Four Person Family In Each State Fiscal State Tax Tax

New Hampshire Property Tax Calculator Smartasset

What Are The Various Appraisal Approaches Appraisal Insurance Sales Work Experience

New Hampshire Property Tax Calculator Smartasset

The Best Place To Buy A Rental Investment Property In New Hampshire

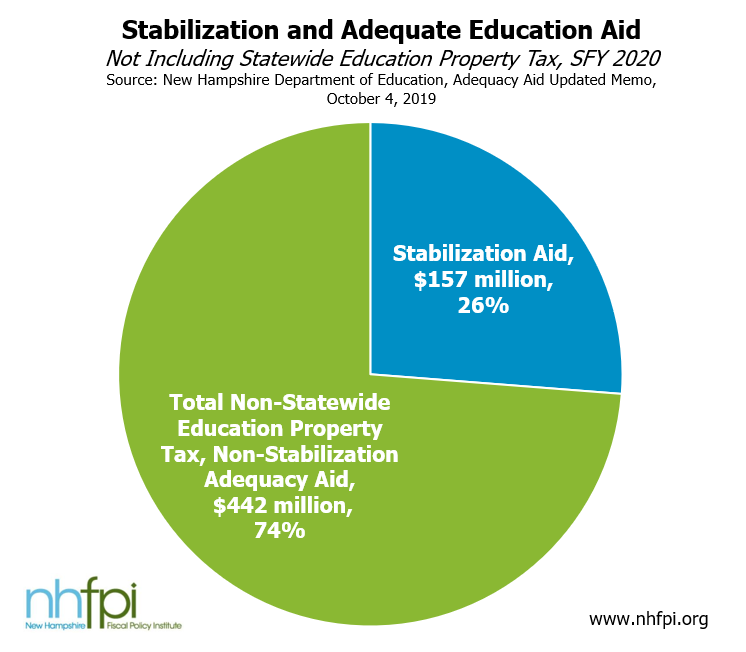

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

New Hampshire Property Tax Calculator Smartasset

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

How To Calculate Transfer Tax In Nh

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

2021 Tax Rate Set Hopkinton Nh